Private Real Estate Investment Strategies

OUR INVESTMENT STRATEGIES

Hawkeye Wealth has helped clients invest directly into dozens of real estate developments, value-add assets, and mortgage investment vehicles with a strong track record of successful outcomes.

You can learn more about our preferred investment strategies and current and past deals below.

OUR MORTGAGE PARTNERS

Hawkeye Wealth has partnered with two select mortgage operators: a residential-focused partnership operated by Neighbourhood Holdings and a commercial real estate debt originator and manager, Peakhill Capital.

PAST DEVELOPMENT AND VALUE-ADD DEALS

CEDAR MEADOWS

Projected Annual ROI: 18-9%

Projected Timeline: 3-5 Years

Equity Required: USD$7,500,000

Multi-family | Phoenix, AZ

CENTRAL PARK REGENCY

Projected Annual ROI: 17-18%

Projected Timeline: 3-5 Years

Equity Required: USD$14,650,000

Multi-family | Houston, TX

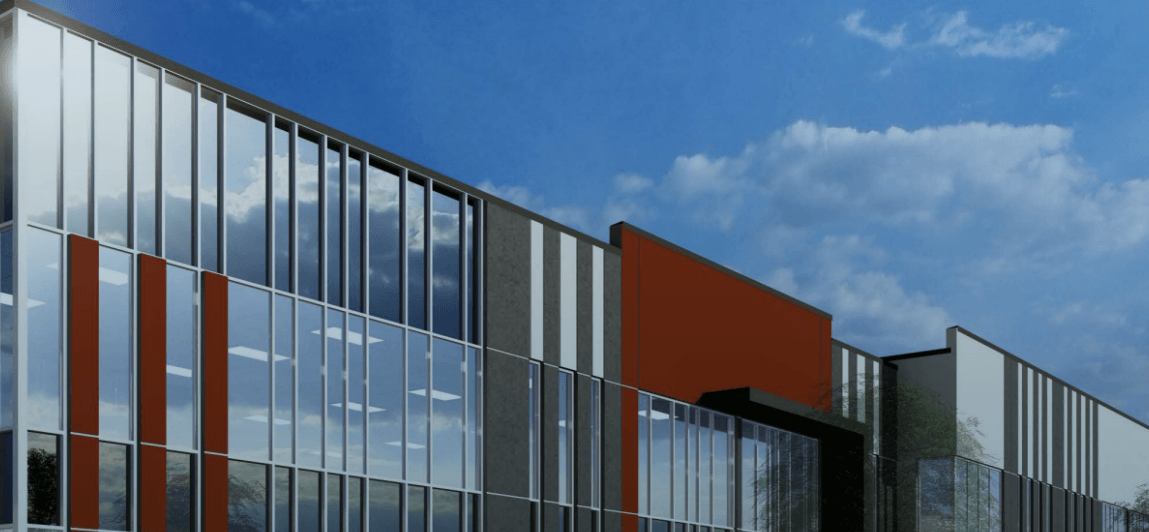

THE BRANDT

Projected Annual ROI: 20%

Projected Timeline: 3-5 Years

Equity Required: USD$30,850,000

Multi-family | Dallas, TX

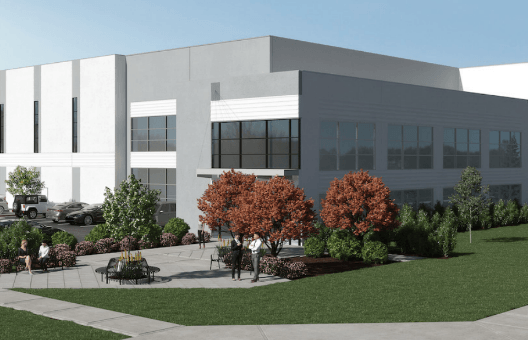

HUNTER'S COVE

Projected Annual ROI: 18-19%

Projected Timeline: 3-5 Years

Equity Required: USD$9,400,000

Multi-family | Dallas, TX