Analyzing CMHCs 2025 Canadian Housing Market Outlook

Most investors would be thrilled with the outcomes forecasted in the CMHC 2025 Housing Market Outlook given the level of uncertainty ahead. The question is, how likely is CMHC to be right?

Introduction

The Canadian Mortgage and Housing Corporation (“CMHC”) has published their 2025 Housing Market Outlook Report, and as we predicted in our May 2024 article, it appears that they significantly overestimated the pricing forecasts they set up 9 months ago. Admittedly, the tariff situation that Canada is facing was a new wrinkle for the market, so we don’t fault them for not taking them into account, but their overestimation of immigration from 2024 onwards was foreseeable.

The result is that in the 2025 Housing Outlook, CMHC has significantly reduced their housing price and rental rate forecasts versus what was projected in 2024, but in our view, they may not have revised far enough.

In this edition of the Bird’s Eye View, we share the key findings from CMHCs 2025 Canadian Housing Outlook, compare how and why their forecasts changed between 2024 and 2025, and give our perspective on whether their updated forecasts are likely to be accurate.

How did the forecast change?

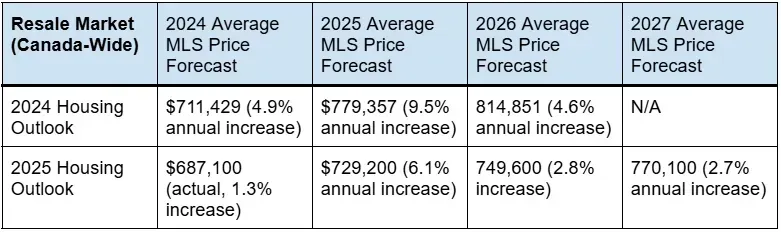

In the charts below, we briefly summarize the key changes between the 2024 and 2025 Housing Outlook forecasts:

Source: 2024 and 2025 CMHC Housing Outlook Reports, data compiled by Hawkeye Wealth

We will dive into the reasoning in the next section, but the short answer is that CMHC has cooled their resale and rental market expectations across the board, with projected housing price increases getting chopped in half, vacancy rates rising, and lower rates of rental price increases.

That said, I think most investors would still be thrilled with these outcomes given the level of uncertainty ahead. The question is, how likely is CMHC to be right?

CMHCs Forecast Rationale

Economic Uncertainty

CMHC begins with a caveat that the forecasts in their report are subject to considerable uncertainty due to foreign trade risks, and that they’ve modelled a ‘low’, ‘medium’, and ‘high’ scenario based on the size and duration of tariffs over the next few years.

Source: 2025 CMHC Housing Outlook Report

While CMHC doesn’t expressly hold out any of these 3 scenarios as being the one they see as most likely, for the purpose of our analysis and for comparison between the 2024 outlook and the 2025 outlook, all figures in this article reference the ‘Medium’ scenario.

Lower Housing Starts

We expect housing starts to slow down over the forecast period, remaining above their 10-year average. The slowdown is primarily due to fewer condominium apartments being built. With low investor interest and more young families looking for family-friendly homes, developers will find it harder to sell enough units to fund new projects. The increase in unsold units will likely reduce new project launches, leading to a decline in new condominium apartment construction.

This finding is consistent with their 2024 forecast, and we generally agree with it. That said, we think they may be slightly overestimating the level of new housing starts in some major markets, notably Vancouver and Toronto, as it doesn’t appear that CMHC is fully considering the tapering of new purpose-built rental projects that has already begun.

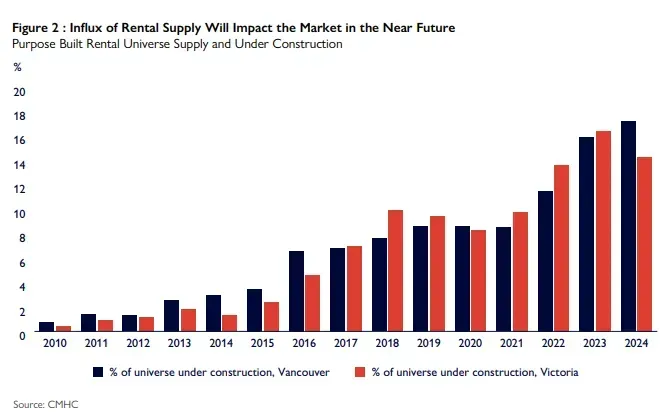

CMHC accurately showcases the massive wave of purpose-built rental projects that are currently under construction (see chart below), but they primarily use it as support for their assertion that “asking rents and rents of new units [will] have limited growth” (Page 11).

Frankly, we think that assertion feels crazy in circumstances where they are projecting out ~6% rental rate increases for the next three years, but putting that aside, they don’t appear to go one step further to consider how the massive backlog in purpose-built rental projects, combined with lower population growth rates may further deter developers from starting these projects.

Source: 2025 CMHC Housing Outlook Report

This chart shows that as of the end of 2024 in Vancouver, a whopping 17.2% of all purpose-built rental units in Vancouver were currently under construction. This is an all-time high figure, and will put downward pressure on rents as inventory comes online. The prospect of high land costs, high construction costs, regulatory and tax hurdles, lower immigration, and an influx of supply has developers looking elsewhere and to other asset types.

Our prediction: CMHC gets it right that housing starts are lower, but that they overestimate the number of new starts in each of 2025 and 2026. One potential caveat would be if the government dramatically reduces development fees, which would lower costs and give developers the confidence to proceed despite lower prospects for rent growth or appreciation.

Home Prices Up

“We expect housing sales and prices to rebound as lower mortgage rates and changes to mortgage rules unlock pent-up demand in the short term. In the longer term, stronger economic fundamentals will support this rebound.”

CMHC's underlying thesis for higher resale prices is that the reduction in immigration demand will have less impact on housing than on rentals, and that lower mortgage rates will prop up housing prices.

It seems like an odd time to be projecting out ‘stronger economic fundamentals’ for 2026 and 2027, but maybe that’s just us?

Our prediction: We think that there is less pent-up demand in the market than what CMHC projects and that fears of economic downturn will prevent large housing price increases in 2025. We see it as unlikely that housing prices rise by the 6.1% forecast for 2025, but feel that their 2026 and 2027 price growth rates are more reasonable.

Rents Keep Climbing

“A record number of units are under construction as part of efforts to increase rental supply… As more new, higher-priced units come onto the market, average rents will continue rising. However, we expect asking rents to be negatively pressured as rental demand declines.”

In this report, CMHC doesn’t give Canada-wide rental forecasts, only regional forecasts. As such, we focus on the Vancouver rental market in this article.

CMHCs rationale for three years of ~6% rental price increases feels incredibly weak, even if they did adjust downward somewhat from their 2024 predictions. Yes, the wave of new units that come onto the market will be priced above current averages, and given the size of that wave, it will have a noticeable effect.

However, even before any economic weakness that stems from potential tariffs, demand is already falling and will continue to do so as plans to slow immigration kick in.

Our Prediction: CMHC is overestimating rental price increases, as they continue to underestimate the slowdown in demand and the cooling effect of new supply. In our view, we anticipate flat or low rental growth rates in Vancouver, and believe that negative rent rates are a real possibility over the next couple of years.

What does this mean for investors?

CMHC continues to paint an optimistic picture for investors in the BC housing market, but in our view, the data is leading us to believe a more bearish stance is prudent when underwriting.

At the least, investors will want to make sure that potential investments will still yield acceptable returns in a lower growth environment than what CMHC has projected.

In the meantime, we continue to look at deals on both sides of the border. While we believe many markets in Canada are in for some turbulence, we are more bullish on U.S. multifamily (see our last article), where a number markets are seeing new supply dwindle and rents are starting to grow again.