Population Declines and the Housing Market: What Investors Need to Know

It doesn’t take a genius to hypothesize that population decreases could cause rental rates and housing prices to soften over the next two years. However, a look at historical data shows that changes in population growth often don’t result in immediate housing price changes.

Introduction

Oh, what a difference a year makes!

August 2023:

“I don’t see a world in which we lower [immigration targets], the need is too great.”

-Marc Miller, Immigration Minister (source)

September 2024:

“There certainly is a world in which we would reduce [immigration targets]”.

-Marc Miller, Immigration Minister (source)

And reduce immigration targets they have. With the Federal Government's release of the 2025-2027 Immigration Levels Plan, there is a very real chance that we go from seeing the highest population growth levels since the 1950s (in 2023 and 2024), to seeing the first annual population decreases in Canadian history in both 2025 and 2026, with annual decreases of ~57,500 people annually.

It doesn’t take a genius to hypothesize that population decreases could cause rental rates and housing prices to soften over the next two years. However, a look at historical data shows that changes in population growth often don’t result in immediate housing price changes.

In this edition of the Bird’s Eye View, we discuss why it is that there is a disconnect between housing prices and population growth, and aim to help investors understand what geographies and housing types are most likely to be affected by the reduction in immigration targets put forward in the 2025-2027 Immigration Levels Plan.

Historical Population Growth vs. Price Growth

The knee-jerk reaction to slowing or negative population growth is to think that prices are going to come down. It’s an understandable reaction, but historically, the immediate correlation between housing prices and population growth hasn’t been as strong as one might expect.

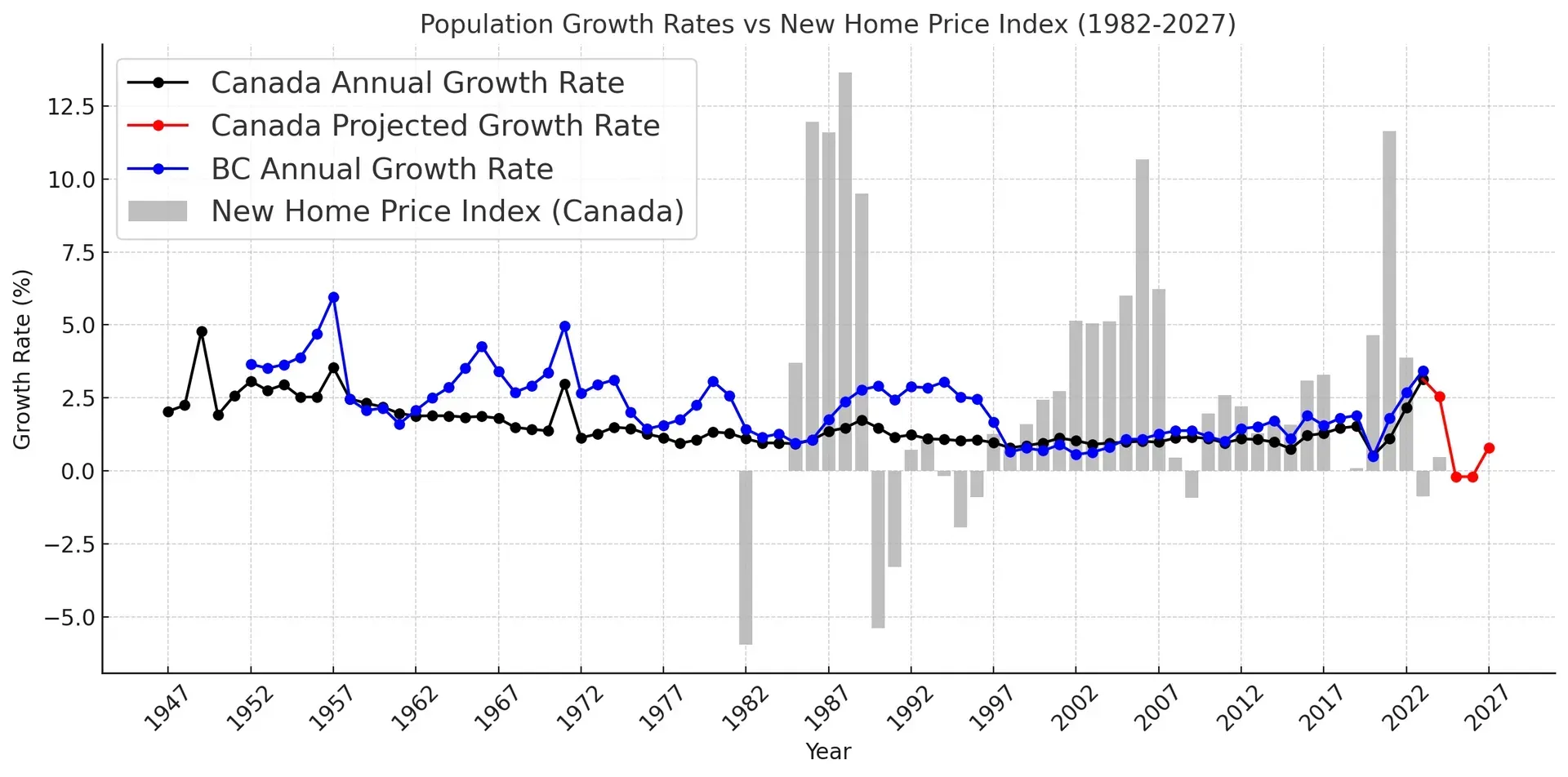

As the graph below hints at, population growth is just one factor among many, and in the past, it’s rarely been the most important one.

Chart created by Hawkeye Wealth, using the following data:

1. Statistics Canada. Table 17-10-0009-01 Population estimates, quarterly

2. Statistics Canada. Table 18-10-0205-01 New housing price index, monthly

In the 1980s, Canada had moderately rising population growth rates (between 1-1.75%), but it was runaway inflation that was the primary driver behind the increase in home prices, not changes in population.

From 1990 to 1996, population growth rates slightly slowed, but remained between 1.1% and 1.7%. However, home prices dropped significantly due to recession and rising unemployment, high interest rates and oversupply following the late 1980s housing boom.

From 1997 to 2007, population growth held stable at a lower rate of between 0.8% and 1.1% per year, but home prices went on a tear as interest rates came down amidst a stronger economic backdrop. This period also saw a rising global interest in Canadian real estate, which contributed to higher prices.

Most recently, in 2023 and 2024, home prices have remained flat, despite extremely high population growth rates of between 2.5-3%.

Explaining the Disconnect

Population growth is an important part of the equation, but there are two primary reasons why changes in population growth tend not to have an immediate impact on housing prices.

First, in most cases, there is a long time lag between population increases and the resulting housing demand. Natural population increases result in demand 25 years later (babies can't afford homes yet) and immigrants and non-permanent residents are disproportionately renters, at least initially. As we discuss in greater detail later, population growth can still move housing prices in the short run, but their greater impact is spread out over many years after the increase in population has occurred.

Second, a stable housing market often has the capacity to absorb an initial surge in demand from population growth, which delays immediate upward pressure on prices. This is less applicable in 2024, but on a historical basis, the principle holds true.

With all that said, it’s also important to remember that if the -0.2% growth rates proposed for 2025 and 2026 do materialize, they are unprecedented. At no point since confederation in 1867 has Canada ever had a negative annual growth rate (Source). Further, there has only twice been a growth rate lower than 0.7%. In 1916, the middle of the first world war, Canada posted a 0.3% growth rate, and in 2021 the pandemic ushered in a 0.6% growth rate.

Looking forward, we acknowledge that given the magnitude and rapid change in immigration targets and the potential for regional concentration of impacts, there is a greater likelihood that these changes will have immediate effect on the market.

With that background information out of the way, let’s pivot to those regions that are most likely to be impacted, and how the market might deal with slow or declining growth.

Which Regions will likely be most affected?

In 2021, the Vancouver, Toronto and Montreal Census Metropolitan areas contained ~36% of Canada’s total population, but were home to ~59% of Non-Permanent Residents (NPRs). Montreal had the highest proportion of NPRs of any city, and the Vancouver CMA had the highest proportion of NPRs of any CMA in Canada at 5.04%. BC had the highest proportion of NPRs of any Province at 3.42 (2021 Census).

What may be even more instructive however, is where the influx of NPRs have landed since 2021. The table below shows the number of NPRs in each province in both 2021 and 2024:

Table created by Hawkeye Wealth, using the following data:

- Statistics Canada. Table 17-10-0009-01 Population estimates, quarterly

- Statistics Canada. Table 17-10-0121-01 Estimates of the number of non-permanent residents by type, quarterly

Interestingly, despite the fact that Ontario, Quebec and BC all gained the most NPRs, on a percentage increase basis, many other provinces saw greater influxes, including Alberta, New Brunswick, Newfoundland, and Manitoba.

For our purposes, the % of all NPRs figure serves as a rudimentary guide for how the reduction of 115,753 NPRs may be allocated across provinces.

If the decrease is proportional to that percentage, BC would see a reduction of ~20,430 over the next two years, Ontario would lose ~53,119 people, Quebec would lose ~22,688 people, and Alberta would lose ~9,781 people.

In our opinion, these reductions may be slightly further skewed towards decreases in Ontario and BC, because the cap on international students appears to be one of the government’s key measures for reducing NPRs, and those provinces have the largest number of international students.

As a note, these reductions do not include what may come from the balance of inter-provincial migration, or natural population change, but both factors could serve to exacerbate the issue in these provinces. For example, in BC, the net interprovincial migration (people in less people out) from July 1, 2023 to June 30, 2024 was -9,199, and the natural population change (births minus deaths) was -3,103 in 2023, and has been negative every year since 2021. If that trend continues, we anticipate that the declines in BC could be higher than the national average.

As we discuss in the next section, the cities and neighborhoods that support universities with a high percentage of international students are likely to feel the most acute impacts. The top universities by percentage of international students are UofT (32.7%), UBC (26.1%), McGill (25.2%) and UofA (23.5%), with SFU, University of Waterloo, and Queen’s University (all at 20%) (source).

What will 2 years of slow or negative growth do to housing?

The answer to this question will likely look very different for the rental and ownership markets.

As mentioned earlier, recent immigrants and NPRs tend to rent.

One study, published in 2021 but based on 2018 data, found that recent immigrants were more likely to live in rented dwellings (56%) than the total population (27%).

Another Statistics Canada publication published in 2023 and based on 2021 data, found that 78.5% of NPRs lived in rental housing.

There is also reason to believe that these figures have increased since then, both because of a tighter housing market, as well as the introduction of the Prohibition on the Purchase of Residential Property by Non-Canadians Act, which came into force on January 1, 2023. This Act prohibits non-Canadians, including NPRs from purchasing property in Census Metropolitan Areas. Barring a change in policy, this prohibition is expected to remain in place until 2027.

If the proposed immigration targets are met, we anticipate that there will be lower demand for rentals, and rent rates should come down as a result. In time, we expect knock on effects to condo and townhome markets as well, as the reduced revenue makes purchasing these as rental properties becomes less attractive.

Investors also need to anticipate the amount of new supply that may come online during the period of negative growth rates, as each new unit has the potential to further drive down rental rates and housing prices.

Calculating New Supply

Investors considering Canadian deals should pay close attention to upcoming supply in the rental market for the area you are considering (as well as the supply for housing types that serve renters).

You don’t need sophisticated tools or data packages to conduct a quick and dirty market review, and the CMHCs Housing Market Information Portal can be a great place to start.

For example, if you review the data for Toronto, you will see that there is a backlog of inventory under construction that is near its all time high, and if the government delivers on their immigration targets, that product might end up being delivered to tepid demand.

In our view, this holds true for many of the Canadian markets we follow. That said, we wouldn’t be afraid to consider projects that we feel will be well insulated from any demand shock that stems from reducing the number of NPRs. We will also look at those projects that that account for the strong potential for rental rates softening on their pro forma. After all, in our view, the seeds of a future rental supply crunch are being sown as we speak once NPR population stabilizes.

Conclusion

As Canada prepares for a new era of reduced immigration targets, the implications for the housing market are both uncertain and complex. While population declines may lead to softer rental rates and cooling housing prices, history shows us that real estate trends don’t always move in lockstep with demographics. The lag between population shifts and housing market reactions offers both challenges and opportunities for investors.

For those keeping a finger on the pulse of these changes, understanding the nuances of geography, politics and the interplay between the rental and housing markets will be critical.

In the end, we know that as investors, it’s our job to be prepared for everything and to find a way to take advantage of any market. We are on the lookout for distressed opportunities in this environment. We also continue to believe in well-managed, low loan to value mortgage funds that are defensively positioned, particularly those focused on lending against existing assets in major markets.

As you navigate the coming years, remember: every market holds opportunities—it’s just a matter of knowing where to look.