How Do Election Results Impact Residential Real Estate Prices?

While we will continue to watch and seek to understand how investors may be affected by who ends up in government and any resulting policy shifts, there is something reassuring about knowing that in the past, real estate has performed well for investors regardless of who is in power.

It’s federal election season in the United States and the Canadian federal election is just a year away.

Elections, particularly federal elections, present the potential for substantial change in a nation’s trajectory. Personally, you might be analyzing how your life, your business, and your investments may be impacted depending on election results.

While we can’t answer that question in all areas, we have conducted research on how the party in power has historically affected real estate values in both the US and Canada.

In this edition of the Bird’s Eye View we analyze this historical data, share our thoughts on weaknesses in the data, and offer commentary on what investors might experience moving forward.

How Federal Government Affects Housing

There are 4 primary ways that federal governments get involved with the supply/demand equation for housing, thereby influencing costs and pricing:

- Immigration Policy - Government can increase or decrease demand for housing based on changes to immigration policy (which can also have secondary effects on supply).

- Policies that Affect Availability of Land for Development - This is more relevant for Canada than the US, where private land ownership rates are much higher (~60% of land in the US is privately owned, vs. ~11% in Canada).

- Direct or Indirect Funding Programs for Housing - These can include subsidies, tax credits, transfer payments, etc.

- Taxation - While federal governments don’t control property tax, changes to capital gains, federal sales taxes, or other related taxes can affect real estate project costs and pricing.

For the foreseeable future, all major parties in both the U.S. and Canada are focused on ‘housing affordability’. This isn’t necessarily a new phenomenon, but the focus is definitely more acute than it has been historically, and investors should be aware that governments, regardless of political leaning, are actively trying to reduce housing prices. Where parties differ is in their approach to how they want to see prices lowered, or the specific combination of the factors above, to achieve that goal.

While the means might be different, the data is fascinating in that it shows similar levels of historical price appreciation in the U.S., regardless of which party is in power. In contrast, there has been more divergence between parties in Canada.

Data Summary

United States

The

All-Transactions House Price Index for the United States tracks residential housing prices that have been securitized by Freddie Mac and Fannie May, back to 1975.

(*If you’ve ever wondered, these nicknames come from the acronyms of each organization: Fannie Mae from the Federal National Mortgage Association (FNMA) and Freddie Mac from the Federal Home Loan Mortgage Corporation (FMCC)).

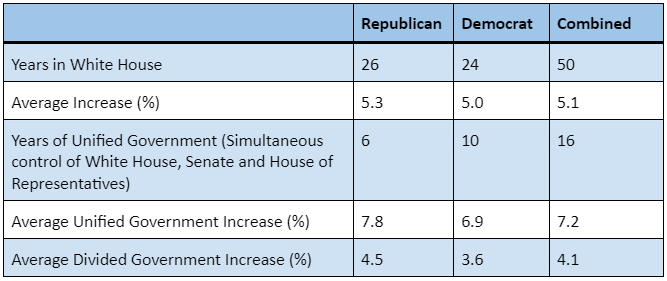

Here’s how housing prices changed over the last 50 years, based on who has controlled the White House:

Notable Observations:

- On average, historical housing prices have appreciated at a similar rate, regardless of whether Democrats or Republicans are in power.

- Unified governments, both Republican and Democrat, saw much higher rates of housing appreciation than divided governments

With regards to unified vs. divided government, it is tempting to hypothesize that unified governments

cause higher rates of appreciation. However, this can’t be determined without further study, and in our opinion, this relationship is much more likely to be

coincidence, as shown by the very different Canadian experience with Majority/Minority governments.

Canada

Canada doesn’t have a direct equivalent to the U.S All-Transaction Housing Price Index, however, it does have the

New Housing Price Index, which beginning in 1981 measures changes only in the sale prices of new homes (and land) in 27 cities across Canada.

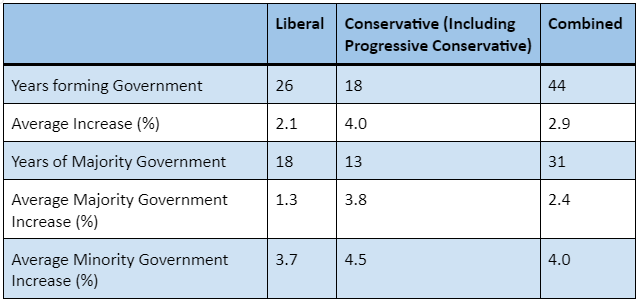

The following table shows average price changes since 1981, relative to who was in power and whether they formed a majority or minority government:

Notable Observations:

- Conservative (including Progressive Conservative) governments have seen higher home price appreciation on average than Liberal governments.

- Minority governments have seen much higher levels of price appreciation than Majority governments, the exact opposite of what the US has experienced with unified governments.

Shortcomings of the Data

Given the simplicity of the data reviewed and our approach to it, it’s necessary that we acknowledge some of the key issues with the use of this data.

First, the significant differences between the US and Canadian indexes makes comparing raw percentages between the two problematic.

Second, there are many other economic factors that affect housing prices at the national level, such as interest rates, GDP, consumer confidence, and consumer debt levels. Analyzing the single variable of who is in government without also analyzing those other variables means we can’t properly measure the impact of government on housing prices (and whether it is causal, correlational, or pure coincidence). As such, this data has limited value for explaining

why prices have appreciated at any given rate.

Third, any fulsome study on this topic should look at the change in housing prices relative to the change in housing costs, which we didn’t do here. Looking at housing price changes alone is only half the picture.

Conclusion

In the US, there has been little difference between Democrat and Republican governments when it comes to home price appreciation, while Conservative governments have historically seen higher levels of price appreciation in Canada.

Unified governments in the US have seen much higher rates of price growth than divided governments, but in Canada, the opposite has been true. Minority governments have seen much higher price growth than Majority governments.

Perhaps there are structural explanations for the different experiences between countries, but much more likely is that other economic factors are more important in driving price changes.

While we will continue to watch and seek to understand how investors may be affected by who ends up in government and any resulting policy shifts, there is something reassuring about knowing that in the past, real estate has performed well for investors regardless of who is in power.

SUBSCRIBE TO THE BIRD'S EYE VIEW