Do Falling Interest Rates Make Real Estate Prices Go Up?

In this edition of the Bird’s Eye View, we cover how real estate prices have historically moved in falling rate environments and explore some of the perils both in forecasting rates and what prices will do as a result of changes in rates.

On June 5th, 2024, the Bank of Canada announced its first interest rate cut in more than 4 years, stating that “with continued evidence that underlying inflation is easing, Governing Council agreed that monetary policy no longer needs to be as restrictive”.

Many experts believe there will be further reductions in 2024, and while we aren’t in the business of forecasting rates, we are in the business of determining how real estate prices might react to a variety of interest rate scenarios.

In this edition of the Bird’s Eye View, we cover how real estate prices have historically moved in falling rate environments and explore some of the perils both in forecasting rates and what prices will do as a result of changes in rates.

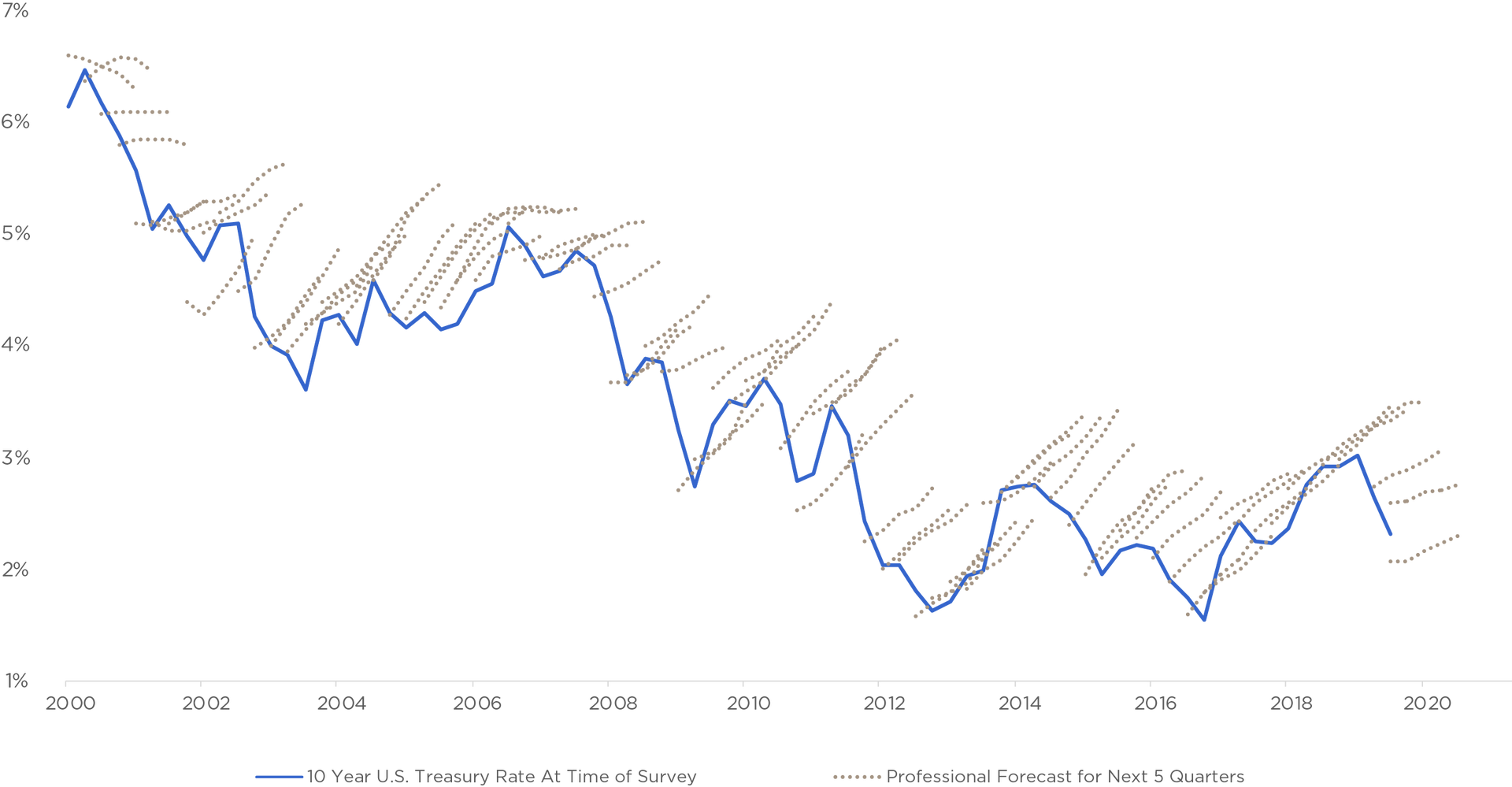

The Peril of Forecasting Interest Rates

It’s important to recognize at the outset that there is a huge amount of guesswork in forecasting interest rates. Even experts and Central Banks are prone to guessing incorrectly.

This point is summarized well by this chart comparing the 10-Year U.S. Treasury Rate, versus forecasts by the Survey of Professional Forecasters:

Source: Professional Forecasters’ Projections. Source: Figure 3 from Kirby, Barry, “Diminishing Returns: The Incredible Shrinking Bond Yield,” CapTrust, October 24, 2019.

When it comes to interest rates, there are so many variables in play that the forecasts of experts are often incorrect. Even Tiff Macklem, the Bank of Canada governor, is now somewhat famous for his July 2020 claim that “if you’ve got a mortgage or if you’re considering making a major purchase, or you're a business and you're considering making an investment, you can be confident rates will be low for a long time”.

All this is to say that when you read the news and see a consensus of experts agreeing that we will see 2 more rate cuts in 2024, take it with a grain of salt. We also believe that’s a likely outcome based on current information, but forecasting interest rates has a way of making even the most informed individuals look like fools.

With that caveat in mind, let’s explore how real estate has performed in previous declining rate cycles to get a better sense of what the future may have in store.

Learning from previous periods of rate decrease

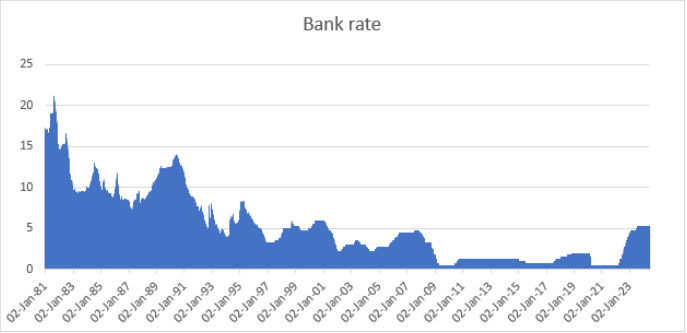

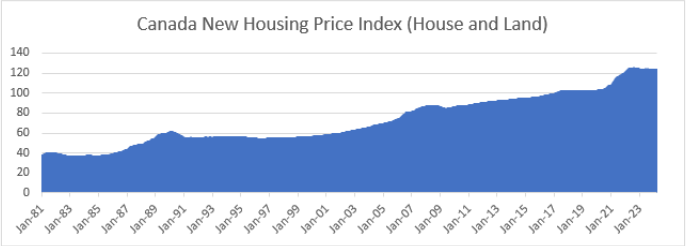

Between August 1981 and March of 2022, Canada saw 41 years of generally declining interest rates, and over that time new house prices in Canada tripled, with an average price increase of ~2.8% per year over that period (adjusted for inflation).

Source Data: Statistics Canada. Table 10-10-0145-01 Financial market statistics, as at Wednesday, Bank of Canada

Source: Statistics Canada. Table 18-10-0205-01 New housing price index, monthly

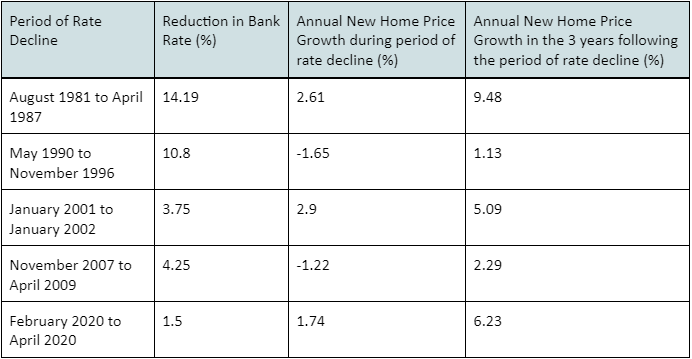

However, looking specifically at the periods of declining rates on the table below, we see some interesting trends:

Each of these periods saw wildly different economic circumstances, and interest rate is only one variable in what causes changes in home price, but for the purposes of this article, it suffices to point out there has historically been a trend of below average price growth in periods of falling rates, followed by a period of above average appreciation.

The average annual new home price growth during the combined 14.83 years of rate decline considered above was 0.38%.

Why? In general, the Central Bank lowers interest rates in response to economic weakness. The low or negative GDP growth, higher unemployment and slower wage growth during these periods tends to slow home price growth more than the added affordability that comes with lower borrowing costs.

However, in the 3 years that follow a period of rate reduction, real estate has historically performed well. The average annual new home price growth during the combined 15 years following periods of rate decline was 4.84%, as lower borrowing costs along with an improving economy supported high price growth.

It’s also worth noting that in addition to the differing economic circumstances from today, these periods saw much larger rate decreases than we are likely to see in 2024-2025, so it’s difficult to know how applicable these previous scenarios are for forecasting.

Conclusion

This has been a whole lot of writing to come to some rather simple conclusions.

First, preparing yourself to be successful in any rate environment is much more fruitful than trying to predict where rates are going.

Second, when you see social media gurus, journalists, or industry insiders asserting that rate cuts are going to cause real estate prices to suddenly increase (Bank of Canada interest rate cut could be ‘tailwind’ for GTA real estate), know that they might be right, but that historically, price growth has been slower during rate decreases.

Third, owning real estate during periods of rate decline hasn’t been particularly rewarding, but the years following have been exceptional.

We don’t know how much and how fast rates will fall, how resilient our economy will be, or who will form government in the next election.

But that uncertainty is causing plenty of fear in the market, and frankly, we don’t mind that. It’s not the time to be swinging at every opportunity, but for those keeping their ear to the ground, there are genuinely exciting investment opportunities in this market.

SUBSCRIBE TO THE BIRD'S EYE VIEW