BC Multiplex Strategy - A Look Under the Hood

In this edition of the Birds Eye View, we aim to improve on the traditional experience of looking under the hood by giving you a guided tour of the multiplex development strategy in BC, which has gained momentum following BCs recent housing legislation changes.

Popping the hood is a right of passage for any vehicle purchaser, though truthfully, most of us have almost no idea what we are supposed to be looking for.

If we don’t see rats nests, the belts aren’t worn and the engine looks clean, it probably passes our inspection. However, we may continue to look for a while, hoping that if something is wrong, it will jump out at us.

Unless you have some mechanical aptitude, I suspect that you’ve had this experience.

In this edition of the Birds Eye View, we aim to improve on the traditional experience of looking under the hood by giving you a guided tour of the multiplex development strategy in BC, which has gained momentum following BCs recent housing legislation changes.

We will conclude by trying to answer the only question that really matters, is this an attractive strategy for investors?

The Model

The model here is simple. Buy land. Design, get permits for, and build between 3-6 units per property. Sell the units on the open market. Do this at scale, rinse and repeat. The goal is to take advantage of the relative simplicity of these projects to keep timelines short and maximize returns.

Why now?

The strategy of building multiple units on a single family lot isn’t new, though it has previously been at least partially constrained by zoning requirements. With the passing of Bill 44, multiplex housing is permitted on all single-family lots in municipalities with a population greater than 5,000, with the amount of units permitted varying between 3-6 depending on lot size.

Functionally, all single family lots in these municipalities got an upzone, but contrary to what usually happens with upzoning, land values didn’t immediately increase because the upzoning happened everywhere. This is one of the key reasons for why this strategy may be advantageous to investors; when you can achieve higher density without having to pay an additional premium for the land, there is an avenue for opportunity.

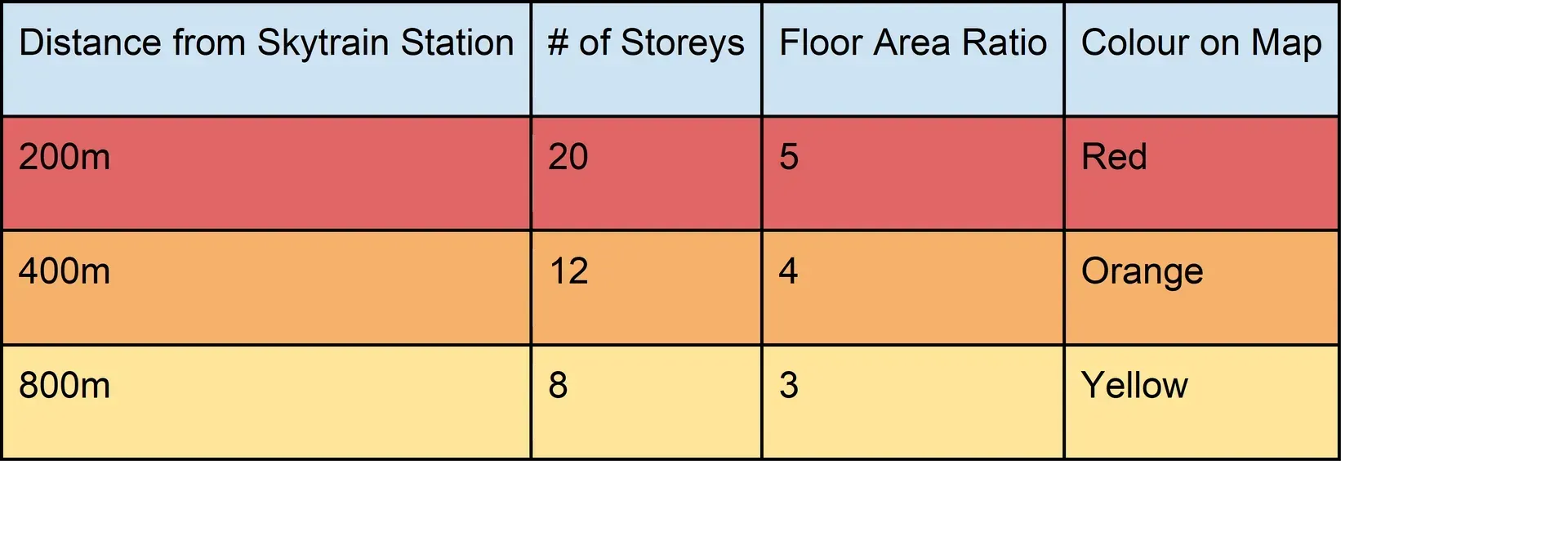

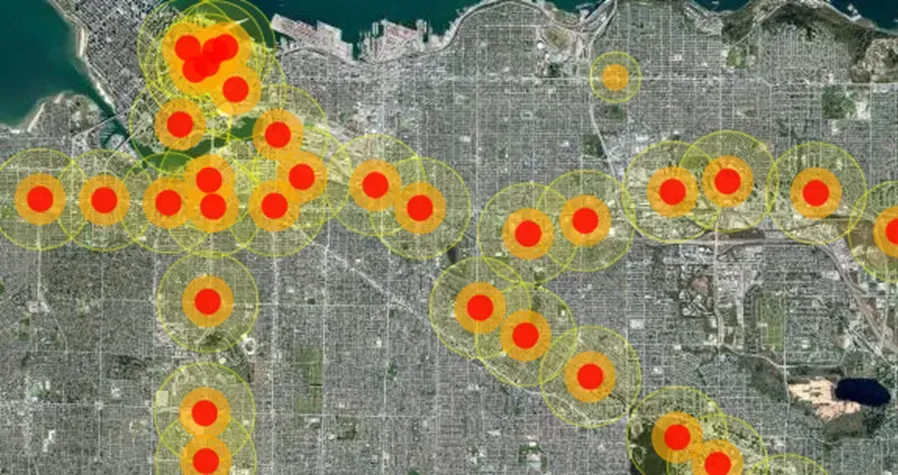

Compare this with the Transit Oriented Development Areas introduced by Bill 47, which allows for higher density in a bullseye around transit stations, as follows:

What we like

There’s lots to like about investing in multiplex housing, so let’s start with the strong points:

- You can buy the land needed quickly and (relatively) inexpensively.

When compared to the land assembly process, which is usually necessary to support multi-family projects in developed areas, it is easier and less expensive to buy a handful of single family lots in good locations.

- Shorter permitting and construction times

Comparatively, these are simpler projects, which leads to shorter development and building permit processes, as well as construction timelines.

- Shorter project timelines provide for (slightly) more visibility into the future

We aren’t advocates of using the crystal ball around here, though when project timelines are less than 2 years, and sales begin even earlier, it makes it easier to establish reasonable assumptions for both costs and revenue based on the current environment.

- Lower building costs

Not needing to provide underground parking and less common space reduces overall building costs.

- Strong projected IRRs

Shorter timelines make for attractive IRRs. The challenge is that returns are highly sensitive to any delays or slow market conditions for unit sales.

What could go wrong

There are diverse ways that things can go wrong with any real estate project, and even though this strategy is comparatively simple, investors should be aware of potential pain points that are unique to this strategy:

- Parking and green space

One of the pros of this strategy, effective utilization of the whole property for building space, does have obvious drawbacks with limited or no parking and minimal outdoor space. Even if the purchase prices are lower than options with these amenities, proximity to transit and parks becomes more important.

Unfortunately, we suspect that most multiplexes will be built outside of Transit Oriented Development Areas (otherwise, why wouldn’t they be developed to even higher density), so it can put these projects in a bit of an awkward spot for transportation.

- First-mover advantage

To date, multiplexes have been hoovered up by purchasers, but it remains to be seen how deep the buyer pool is for this style of property compared to more traditional styles such as condos, townhomes, and duplexes. The level of demand is one reason we suspect this is a strategy where it will be better to be early than late. Another is that each additional multiplex on a street may exacerbate parking issues, which may make the 10th multiplex on a street a less attractive product than the 1st multiplex on a street.

- Infrastructure Upgrades

One major challenge with this type of development is that infrastructure in single family neighbourhoods is often insufficient to support anything more than single family houses. Sewer pipes could be undersized and electrical upgrades may be required, etc. In our experience and from conversations with developers, negotiating who pays for what upgrades and setting up latecomer agreements can present both a time and financial hurdle with this type of development.

- Finding the Right Development Partner

Finding the right development partner is always critical, and the size and scale of these projects generally lends itself to small to mid-size developers, where the track record may not be as extensive, or there is less capacity to implement this strategy at scale.

Conclusion

At Hawkeye, we pride ourselves on being strategy agnostic. We are regularly out looking for the strategies and jurisdictions that present the most attractive real estate investment opportunities. What this means is that we get to look under a lot of hoods.

For the most part, we like a lot of what we see with the BC multiplex strategy and there is likely opportunity here for investors. While we haven’t found the right project to take a swing at this strategy just yet, we are keeping our eyes and ears open.