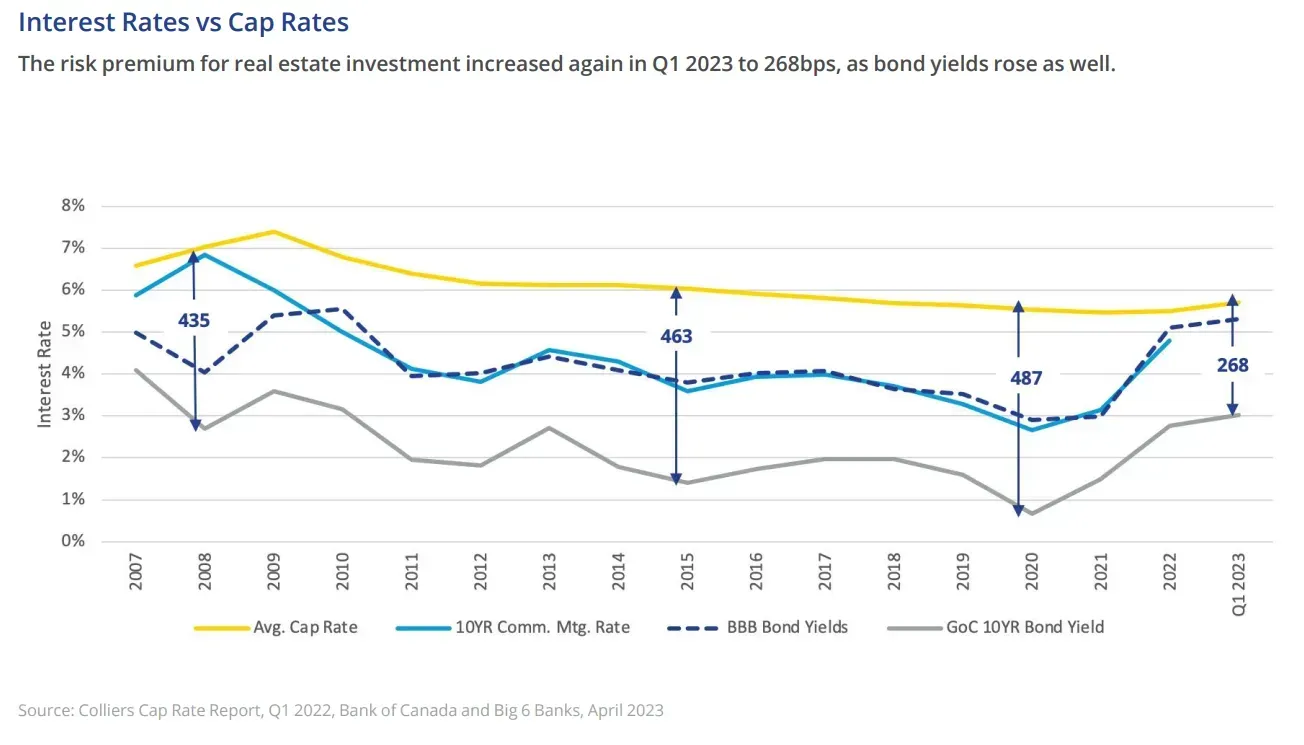

The 15-year historical average spread between the 10-year treasury yield and cap rates in Canada has been ~400bps. In other words, investors have historically required an average of 4% additional yield over the risk-free rate to be induced to invest in commercial real estate.

While the above averages include all markets and asset classes, there is considerable variance across these. For example, Altus Group data from Q3 2023 indicates that there is more than 200bps of spread between the cap rates for suburban multi-family residential (4.66% cap rate) and downtown class “AA” office (6.69% cap rate).

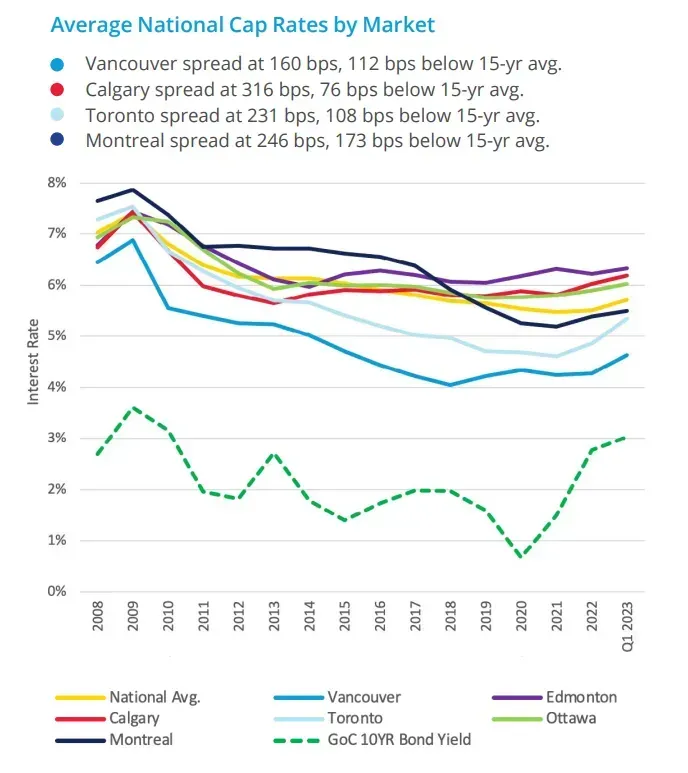

Data from Colliers (see right) also shows the considerable variance between average national cap rates based on market.

On average, cap rates in Vancouver tend to be lower than cap rates in Alberta. In all markets, the cap rate spreads are considerably below historical averages.

If history is a guide and interest rates stay higher for longer as has been forecasted by the Bank of Canada, we anticipate that asset prices will fall and cap rates will likely rise over time and settle in closer to historical averages.

Introducing the Negative Cap Rate Spread

From March 2023 (when the above charts were produced) to now, 10-year bond yields have risen aggressively on the strength of ‘higher rates for longer’ rhetoric from the Bank of Canada, to where they now sit at 3.725%. Cap rates have edged up, but multi-family cap rates have remained sticky due to strong market fundamentals. In short, the spreads have narrowed even further.

So where does that put us? According to Colliers Q3 Canada Cap Rate Report, some markets and asset classes are firmly in negative cap rate spread territory. For example, in Vancouver, multi-family apartments have been trading at cap rates of between 3.25% - 4.00%.

It begs the question of why investors are choosing to invest in a real estate asset at a going-in cap rate of 3.5% if they can go get a 10-year, risk-free bond at 3.725%. Said another way, why do some investors view multi-family assets in select markets as having less risk than the risk-free rate? It’s a strange world indeed.