A Deep Dive on Rental Growth Rates

In this edition of the Bird’s Eye View, we take you on a deeper dive through both the art and science of one of these variables: rental rate growth.

Underwriting a multi-family real estate deal is a mix of art and science. Projected investment returns are highly dependent on the assumptions you make, especially about cap rates, deal timeline, interest rates, government regulation, inflation rates, vacancy rates, and rental growth rates.

The science part of underwriting comes from using the best possible data, combined with knowledge of economic patterns, to evaluate a range of scenarios that could play out in a given project, market and asset class.

The art part of underwriting comes when we attempt to establish probabilities for each of these potential scenarios.

In this edition of the Bird’s Eye View, we take you on a deeper dive through both the art and science of one of these variables: rental rate growth.

Rental Rate Growth

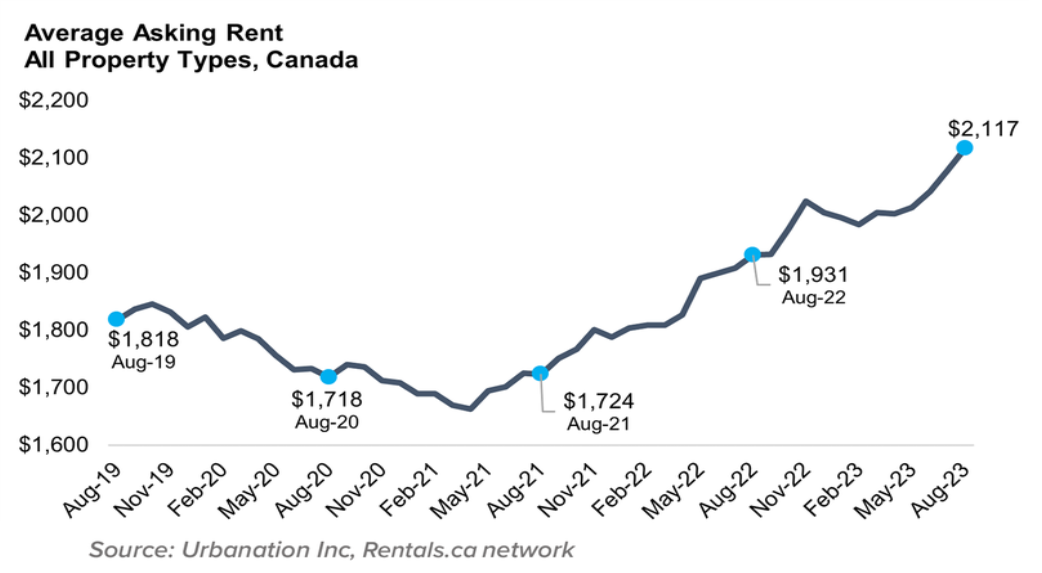

Since early 2021, rental rates in Canada have been rising at unprecedented speeds. The question is, will they continue or will the trend reverse? To answer, we need to understand the supply/demand equation and what has driven rental price increases.

Demand

The story of real estate demand in Canada is synonymous with the story of immigration and temporary residents, and the rental rate chart above tracks closely with immigration levels.

In 2020, as a result of border closures, Canada brought in the lowest totals of immigrants and temporary residents seen in recent history. The result is that Canada’s population only increased by 134,449 (while 198,761 new units of housing were completed). This brought a corresponding decrease in rents.

In 2021, immigration numbers reversed to record-breaking levels, which records were further broken in 2022, and likely will be again in 2023.

For 2022,

Statistics Canada reported, “international migration accounted for nearly all growth recorded (95.9%) [...], Canada welcomed 437,180 immigrants and saw a net increase of the number of non-permanent residents estimated at 607,782.” The total increase in population from these sources was approximately 1,044,962 people in that year.

Though the counts aren’t yet official for 2023,

Statistics Canada is projecting an even higher rate of population growth on the heels of a record breaking 1st quarter in 2023, with 98% of population growth coming from immigration and temporary residents.

Immigrants and Non-permanent residents (NPRs) are primarily renters

According to another 2021

publication, “recent immigrants were more likely to live in rented dwellings (56%) than the total population (27%), owing to a greater proportion of individuals in both subsidized and non-subsidized housing.”

Further,

Statistics Canada cites that in 2021, 78.5% of NPRs lived in rental housing.

If these proportions hold true, in 2022, Canada added 721,930 people to the rental pool from immigration alone.

This is an increase in rental demand at a level that is completely unprecedented in Canada.

What would happen if we slowed immigration?

If we are bringing in over 1M+ people into Canada each year, and 96-98% of population growth is explained by immigration, wouldn’t slowing down immigration drastically slow rental rate growth?

The answer is yes, but it would also cause detrimental effects on the economy because of Canada’s low birth rates, aging population, and labour shortages.

Consider these chilling quotes from

Statistics Canada:

“Immigration accounts for almost 100% of Canada’s labour force growth.”

“Canada’s aging population means that the worker-to-retiree ratio is expected to shift from 7-to-1 50 years ago to 2-to-1 by 2035.”

“Immigrants account for 36% of physicians, 33% business owners with paid staff, and 41% of engineers.”

Canada’s economy has become highly dependent on immigration and NPRs.

On a going forward basis, the

Government of Canada’s Immigration Levels Plan for 2023-2025 sets a target for immigration levels to increase further to 500,000 by 2025 (while the rate of new NPRs has been high for 2023, it remains to be seen whether Canada will bring in as many NPRs in future years).

This plan is revised every year by November 1st, and the Immigration Minister, Marc Miller, has indicated that he doesn’t see targets decreasing in the 2024 - 2026 plan. “I don’t see a world in which we lower [immigration targets], the need is too great … whether we revise them upwards or not is something that I have to look at but certainly, I don’t think [we will] lower them”.

At this point, it isn’t clear how immigration targets may change if there is a change in leadership at the Federal level. Pierre Poilievre hasn’t specifically answered the question of whether he would reduce immigration targets, but he has clearly taken the stance that he would implement policy to accelerate supply.

What happens to rental demand if we see a recession that heavily affects employment?

Though we have heard no talk of this in the media, we feel that

if

we entered a recession that seriously affected employment, there is a possibility that rental rates could decrease.

If there is a recession that seriously affects employment (compared with a recession where there is still full employment), many temporary foreign workers will lose their jobs and be required to return home.

This is an untested assumption, but seeing as

immigrants have been disproportionately affected during previous recessions, we anticipate that the huge number of temporary foreign workers, brought in to fill labour shortages, may experience job loss at a higher rate in a recession. If this happened at scale, Canada would likely see low population growth, or even population decline, and rents could drop significantly.

While we see this as a low probability outcome, it is an important risk to consider.

Other factors affecting rental demand

- Affordability of ownership - As the costs of ownership continue to rise, largely due to higher interest rates, we anticipate that some people may choose, or be forced into renting as a lower cost alternative.

- Freedom of mobility - Across all age groups, there is a greater proportion of renters compared to homeowners than a decade ago (RBC, The Rise of Renters). For those that express a preference to rent, freedom of mobility is often cited as a primary reason.

Supply

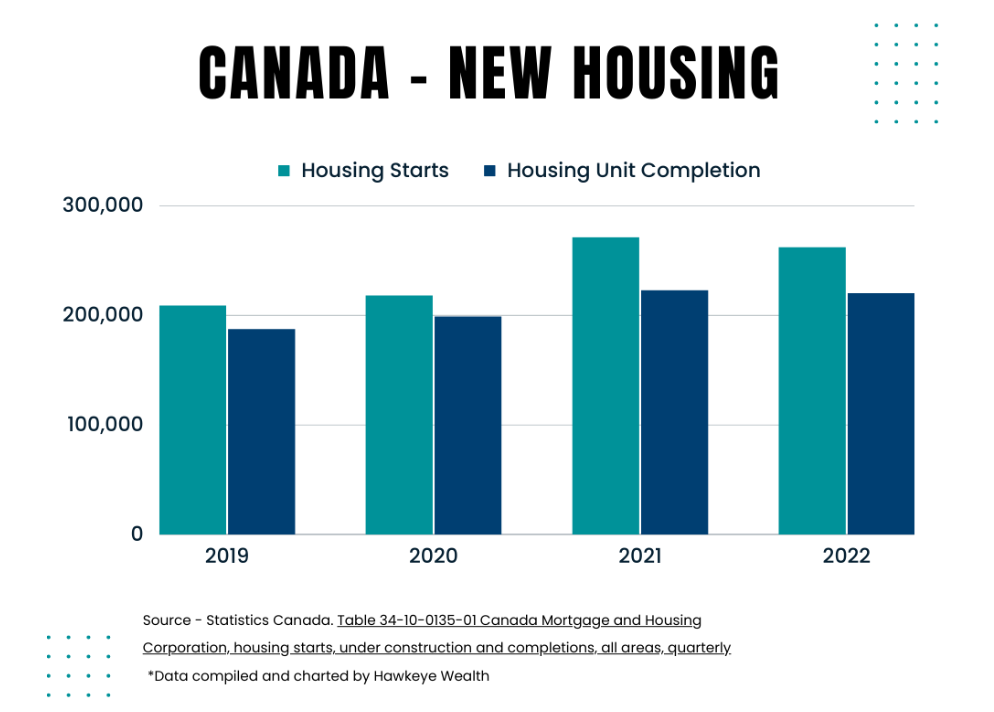

Over the last 4 years, Canada has averaged 239,903 housing starts and 207,138 units completed each year.

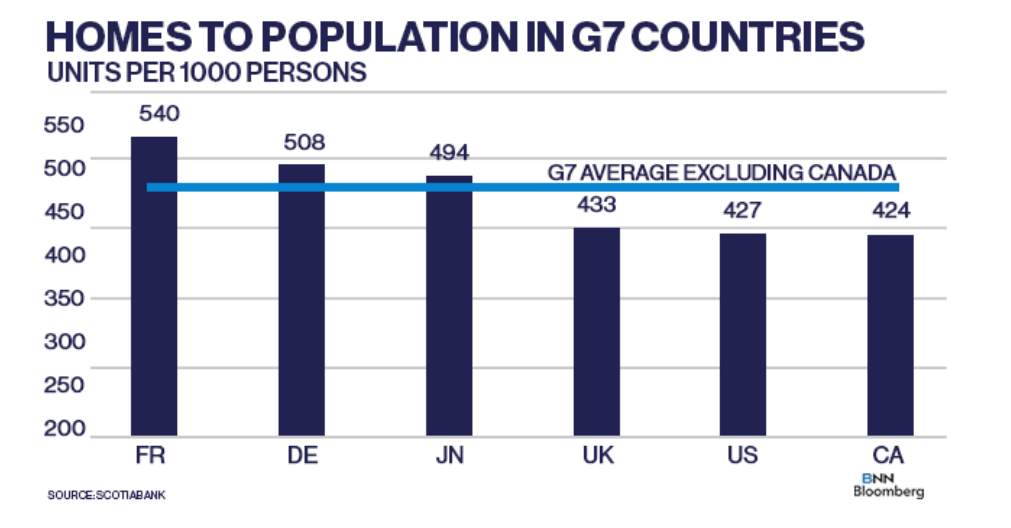

This total is woefully insufficient to meet current demand. In 2020, Scotiabank released a housing brief that indicated that Canada had the lowest number of homes per 1,000 people, at 424.

In 2022, Canada would have needed to construct 445,246 new housing units, just to maintain our worst-in-class average. Instead, we added 219,942 new housing units, which equates to 209 units per 1,000 new people in Canada.

While this analysis is slightly simplistic, it makes it painfully obvious why rents are increasing. Canada added half as many units to the supply as it needed to in order to maintain the historic equilibrium.

How likely is it that Canada will be successful at increasing supply?

Regardless of who is running the federal government, given the public outcry and focus from all parties, it is likely that new housing starts will increase over the next 3 years.

However, we are sceptical that there is any chance of doubling the number of housing units completed per year in the near term. Incentivizing development with policy, such as the recently announced GST rebate will make an appreciable difference, though there are two other hurdles that must be overcome for massively increasing supply to become a legitimate possibility.

First, we do not presently have enough construction workers to support a vastly higher level of construction. Unfortunately, labour shortage has been a barrier even at present levels of construction. (For an in depth read on this point, check out

CIBC’s recent Economic Report)

Second, without sweeping changes to municipal development approval processes, processing a much higher number of applications in a shorter period of time is a pipe dream. As a former City Manager, I don’t have any confidence that this could be done quickly, unless senior levels of government are willing to override municipal authority, a proposition that would bring its own set of issues.

Conclusion

Canada’s current level of construction is sufficient to support annual population increases of approximately 518,731 at present levels of affordability. All indications are that Canada intends to expand its population at nearly double this rate, and it is unlikely that increases in supply will be able to keep up.

Though we still underwrite conservatively, since immigration policy could change quickly, or we could experience a major recession, we anticipate that we will continue to see strong rental rate growth over the next 3 years.

Though this is only one variable of many, we hope that it gives you a sense of the types of considerations we make in the process of underwriting investment deals. We can’t predict the future, though we take pride in our role in vetting deals, researching, and talking with industry experts, and using that information to present you with the best possible real estate investment opportunities.

SUBSCRIBE TO THE BIRD'S EYE VIEW